To understand the real estate market, and to be able to make informed decisions about where it’s headed, we need to look at a lot of factors but in this post I want to talk about inventory and interest rates. One of the key questions I get asked all the time: what’s the future of interest rates?

Interest Rates: The Pendulum Swings

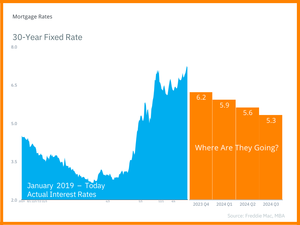

Interest rates are obviously a hot topic, and rightfully so. The relationship between interest rates and the real estate market is crucial. Right now, interest rates are hanging in the balance. If they go down, it’s likely that even more buyers will re-enter the market, potentially driving prices even higher. However, if rates go up, especially above 8%, there’s a chance the market could stall. In my opinion, right now is a smart time for buyers to really focus on their home search–there’s slightly less competition right now and buyers may have some leverage for more favorable terms such as seller paid interest rate buy downs, repairs following inspections, and slight price reductions. Prices peak in the Spring and I expect to see a busier 2024 if rates inch lower than where they are right now.

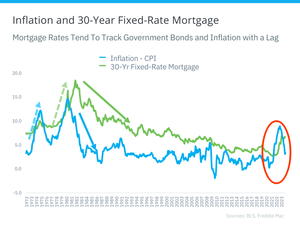

But here’s the kicker: it’s not just about interest rates. It’s about inflation too. Inflation and interest rates are intertwined. When interest rates are under control, inflation tends to follow suit, and vice versa. Currently, inflation is on the rise, signaling a fast-moving economy. As we’ve seen, interest rates are closely tracking this trend.

In simple terms, a good economy equals high interest rates. A bad economy equals low rates.

So, what can the government do? They can raise interest rates faster than inflation, taking control of the situation. This makes borrowing more expensive, leading to reduced consumer spending and eventually, lower inflation. As a result, interest rates can come down to more favorable levels.

Where will interest rates go in 2024?

Rhode Island’s Real Estate Landscape

Now, let’s bring it closer to home – Rhode Island. Here’s what you need to know:

- Median Sale Price Soared in August: The median sale price for the month of August 2023 peaked at an impressive $450,000 for single family homes. This tells us that the real estate market here is vibrant and desirable.

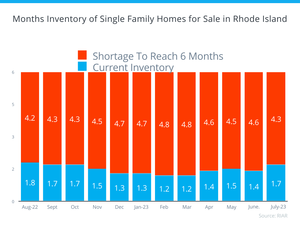

- Inventory Levels: Our current inventory stands at 1.8 months of inventory, which is significantly lower than a balanced market which would have a 6-month supply of inventory. This means it’s a very competitive seller’s market, with homes in high demand and fewer choices for buyers.

With the most recent jobs report and economic data, I believe that The Feds will raise rates later this Fall or early winter. I won’t be surprised if we see rates hit 8%. And because we have such a shortage of inventory I don’t believe that will make much of a dent in home prices. Especially not overall–it may mean prices go down for a bit but as soon as rates are lowered buyers will be back in droves. The real estate landscape in 2023 is dynamic and complex. While interest rates remain a critical factor, the situation is interwoven with inflation. The key is to stay informed, stay connected, and work with professionals who understand these nuances. Check out my most recent Market Update where I really dive into all of the metrics that are affecting our real estate market.

If you find information like this helpful for your home buying or selling process, whether it’s now or in the future, don’t hesitate to reach out. I’m here to serve as your guide and advocate throughout every step of the home buying and selling journey. Stay informed, stay empowered, and let’s make your real estate dreams come true!