If you’re feeling confused about the current real estate market and understanding the price of homes, you’re not alone. News outlets, family members, popular social media sites–they all have very loud opinions and there’s always someone screaming from a rooftop warning that real estate prices are plummeting, even when the data tells a different tale. Part of the confusion stems from unreliable sources, and a lot of click-bait info with the ultimate aim of selling ads or products, that misinterpret the real story behind the numbers.

There’s a lot of national data that I regularly follow in order to stay abreast of the real estate market. While our local Rhode Island market is specific town by town, and even street by street, it’s crucial to stay up to date on the national and regional news as well as local data—I follow it all in order to help ensure my clients are well informed.

Cutting through the noise, here’s the lowdown in my signature style:

Decoding Normal Home Price Seasonality

In the housing market, there’s a rhythm called seasonality. Spring takes the lead as the prime home buying season, keeping the market bustling. Every year I have an abundance of buyers that reach out towards the end of January who tell me they are ready to get started on their home journey that Spring. We’ll get to whether or not that’s the best strategy later on.

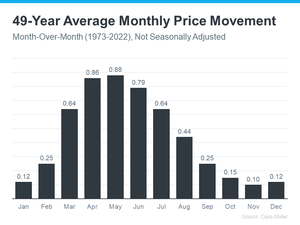

Many Seller’s to wait until the trees have greened and flowers are blooming to put their home on the market–curb appeal is a real factor and it’s not rocket science to understand that first impressions make a huge deal for potential buyers. Home prices typically peak in the months of May, June, and July (work backwards because that’s Sold data which means those properties listed 45-90 days prior). Home prices appreciate the most when demand hits its peak. That’s why there’s a reliable long-term trend in home price appreciation.

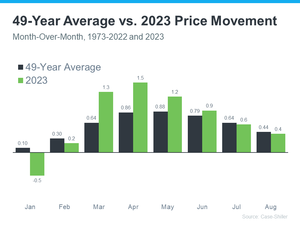

Check out this graph using Case-Shiller data, revealing the typical percent change in monthly home prices from 1973 through 2022 (unadjusted for that authentic seasonality feel):

As the data unfolds, home prices grow at the year’s start, but the real crescendo happens in the spring and summer. Why? Well, fewer folks make moves in the cooler months, so the market takes a breather. Come spring, the beat picks up, and prices soar. As autumn and winter approach, prices still climb, just at a gentler pace as the market eases back.

This Year, Seasonality Takes the Stage Again

Now, let’s dissect how this year stacks up against the long-term trend:

The latest data, represented by those vibrant green bars, is aligning with the typical market behavior. It’s a positive shift, signaling more sustainable price growth than we’ve seen recently. In a nutshell, national prices aren’t taking a nosedive; they’re simply easing into a more normalized growth pattern. Brace yourself for potential media hype misinterpreting this slowdown as a plunge. Stay critical of headlines and seek insights from a trusted real estate professional for the real story. In my last market report I talked about the fact that at the end of 2022 many economists and experts predicted that prices would decline in 2023–that is NOT what we’ve seen and it was not what I anticipated (see my 2022 year end market report on my youtube page).

Final Note: Normalcy Returns to Home Price Appreciation

Home price appreciation is returning to its normal seasonality, and that’s music to my ears. If you’re curious about the price scene in our local domain, let’s connect. Your questions deserve answers tailored to our market’s unique rhythm.